PTS

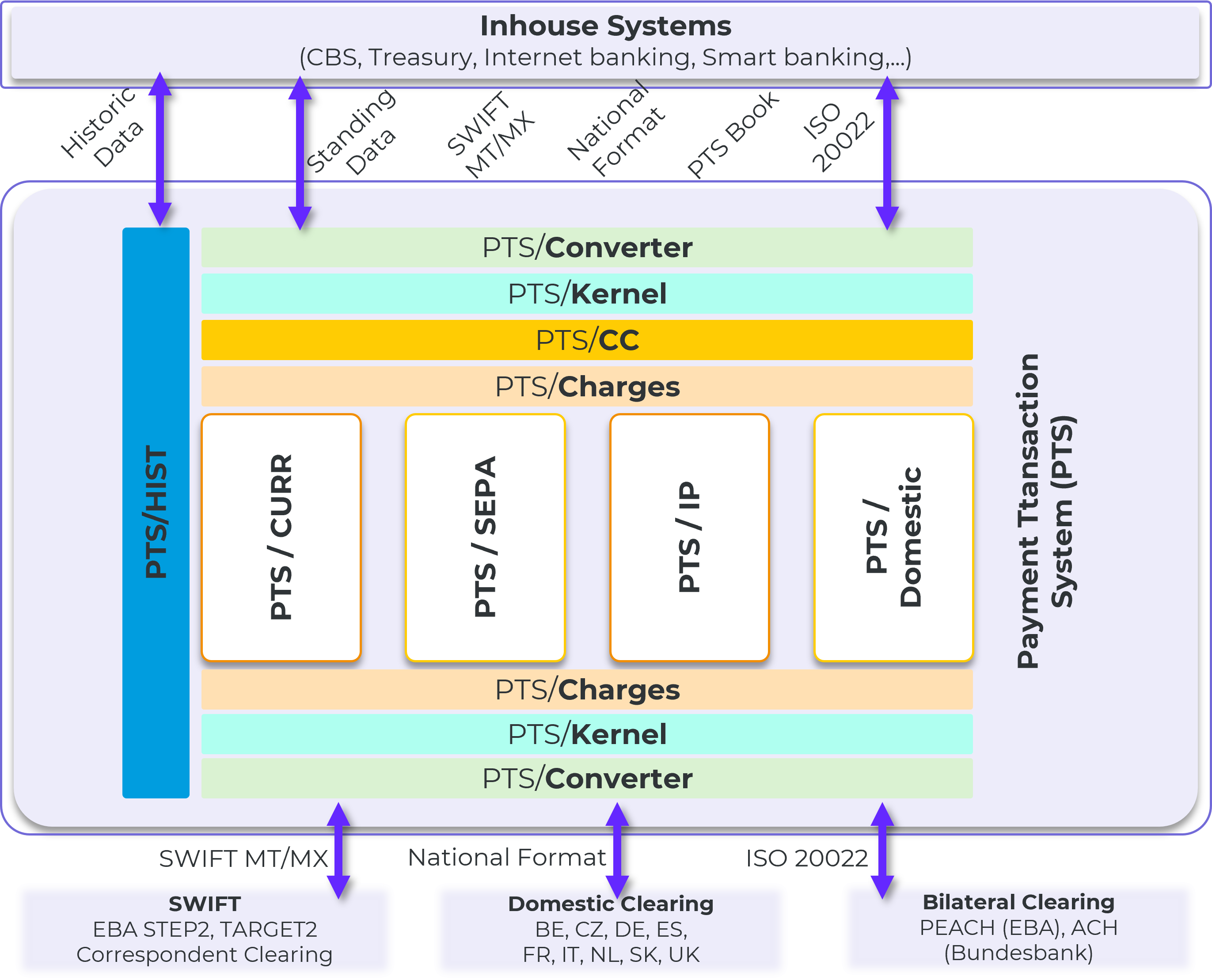

The Payment Transaction System (PTS) is a flexible STP-based automated payment solution with full ISO2022 support for processing all types of domestic, foreign and cross-border payments. Connectivity to local (CERTIS, SIPS) and international (STEP2, TARGET, TIPS) clearing systems as well as interfaces to SWIFT or partner banks are a part of the solution.

The system is designed for

- Banks

- Credit unions

- Payment service providers (PSP Fintech)

Description of PTS modules

- PTS/Kernel (global STP system core)

- PTS/CURR (multi-currency payment system for correspondence payments with full SWIFT support)

- PTS/A&R (analysis and provision of routes based on standard directories and defined bank priorities)

- PTS/SEPA (standard processing of SEPA transactions according to the EPC, in the SK/CZ variant, including account protection levels, mandate management, etc.)

- PTS/IP (instant payment processing, in the CZ version including xAMOS interface, in the EU version with TIPS/RT1 clearing support)

- PTS/Reconciliation (module for reconciliation of nostro accounts)

- PTS/CC (individual customer conditions - currency exchange, exchange rates, rates...)

- PTS/Converter - intelligent bi-directional conversion module for automatic conversion of data formats

System advantages

Processing of all types of payments integrated into one product:

- Processing of all client and interbank transfers

- In all currencies traded

- Domestic, foreign and cross-border payment transactions - Cheque processing (if the clearing system allows it)

- Standing orders, direct debits

- Local and correspondent clearing

- Generation of accounting entries & reporting

- Support of individual conditions for clients (fees, rates, currency exchange)

- Credit risk management (available balance control)

- 4/6 eye check for manual operations

- User permissions according to their role for all manual processing steps

- Fundamentally transactional processing (Commitment Control)

- Validation of input data against reference/permanent data

- Full support for IBAN, internal and external account numbers including control numbers

- Automatic duplicate checking, PDE/PDM processing for SWIFT transactions

- Screening of payment transactions against individual and OFAC/EU-CFSP lists

- Communication with STEP2, TARGET2 and other RTGS systems (processing of MT012, MT019, Ack/Nack or pacs.002) and the SWIFT network

- High level of STP, automated processes - payment routing, fees, exchange rate assignment, currency exchange, etc.

Downloads

Please enter your email address in the form on the right. We will send you an e-mail with a link to the downloads available for this section.

Would you like to know more?

Pavel Hanzlík

Director of Banking Solutions

Would you like more information about the product? Please contact us. We're happy to help.